Regarding Medicare, you must pay the Medicare tax on all your employee and 1099 self-employment income, no matter how high.Bringing in multiple forms of bacon? You’ll need to do some extra work, so keep these tips in mind when filing with a 1099 and W-2. For 2019, the wage base increases to 132,900, so an employee with wages up to or above the maximum in 2019 would pay $8,239.80 in tax and the employer would pay an equal amount. If your employee wages exceeded the annual Social Security tax limit, you wouldn't have to pay any Social Security tax on your 1099 income. You must file IRS Schedule SE, Self-Employment Tax, to calculate and report your Social Security and Medicare taxes. If you don't pay enough estimated tax during the year, you may have a hefty tax bill due with your annual return.

#W2 contractor expenses series

Ideally, you prepay these taxes four times a year by paying a series of estimated taxes every quarter. When you work as a 1099 independent contractor no income, the firms that hire you withhold from your compensation Social Security or Medicare taxes. Business travel, meals and entertainment.Health insurance for yourself and your family.

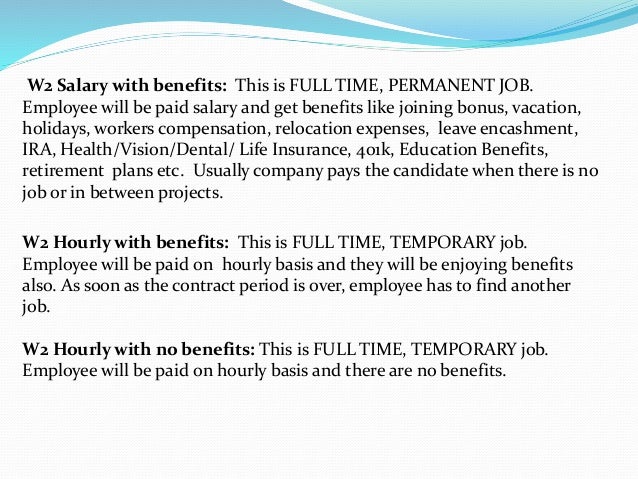

This information includes withholding of income tax and Social Security and Medicare taxes. The W2 form will show your total taxable compensation for the prior year and the total tax withheld from your pay and sent to the IRS. When you work as an employee, your employer will file Form W2, Wage and Tax Statement with the IRS by January 31. You'll need to file IRS Form 1040, not the shorter Form 1040A or 1040EZ. Your taxes will be more complicated if you are both a W2 employee and a 1099 independent contractor. Non-employees who sell their services to others are also called independent contractors.

Their companies report their payments to the IRS on Form 1099-MISC, Miscellaneous Income. 1099 workers are sometimes called "non-employees" or freelancers or consultants. Employers report their wages and other compensation to the IRS on Form W-2, Wage and Tax Statement.

But, here's what you need to know about filing taxes with a 1099 and W2. We'll dive into the specifics of your filing requirements below.

#W2 contractor expenses how to

Here's how to file taxes when you have a W.

#W2 contractor expenses drivers

Good examples are employees who moonlight as part-time drivers for Uber or Lyft. Today, lots of people work as employees and have their own businesses on the side.

0 kommentar(er)

0 kommentar(er)